How AI Is Changing Finance Operations in 2026 and Beyond

Finance isn’t just about keeping the books balanced anymore—it’s about enabling smarter decisions across the enterprise. CFOs face growing pressure to deliver timely insights, stronger controls, and more strategic value while operating with leaner teams and rising compliance demands. Yet many finance organizations still rely on spreadsheets, slow reconciliations, and forecasts that struggle to keep pace with market volatility.

AI has moved from experimentation to real deployment in finance. It’s increasingly shaping how organizations close their books, manage working capital, detect risk, and plan ahead. Gartner predicts that by 2028, a significant share of finance work will involve AI-enabled analysis and decision support. By 2026, CFOs are using AI to surface exceptions earlier, shorten cycle times, and respond to change faster—so finance can anticipate shifts rather than react.

Where Traditional Finance Falls Short and Why It Matters Now

Legacy finance models are under increasing strain. Spreadsheet-heavy, manual processes—from data entry to reconciliations—create bottlenecks that ripple across the business. Manual cash application can contribute to higher Days Sales Outstanding (DSO), tying up working capital. Slow month-end closes delay critical decisions, while static forecasting models often fail to anticipate disruptions.

According to a survey, finance professionals often spend only a limited portion of their time on high-value work such as generating insights and driving actions, with a large share of time going to data collection and validation. This leaves less room for strategic analysis. In this environment, manual tasks aren’t just inefficient—they can also increase risk. Fragmented audit trails can create compliance gaps, delayed reporting can erode stakeholder confidence, and forecasting blind spots can weaken planning.

By contrast, AI for CFOs can help convert these pressure points into improvements. Through intelligent automation and predictive analytics, AI is helping finance teams operate with greater speed, consistency, and control—supporting faster closes, better cash visibility, and more confident decision-making.

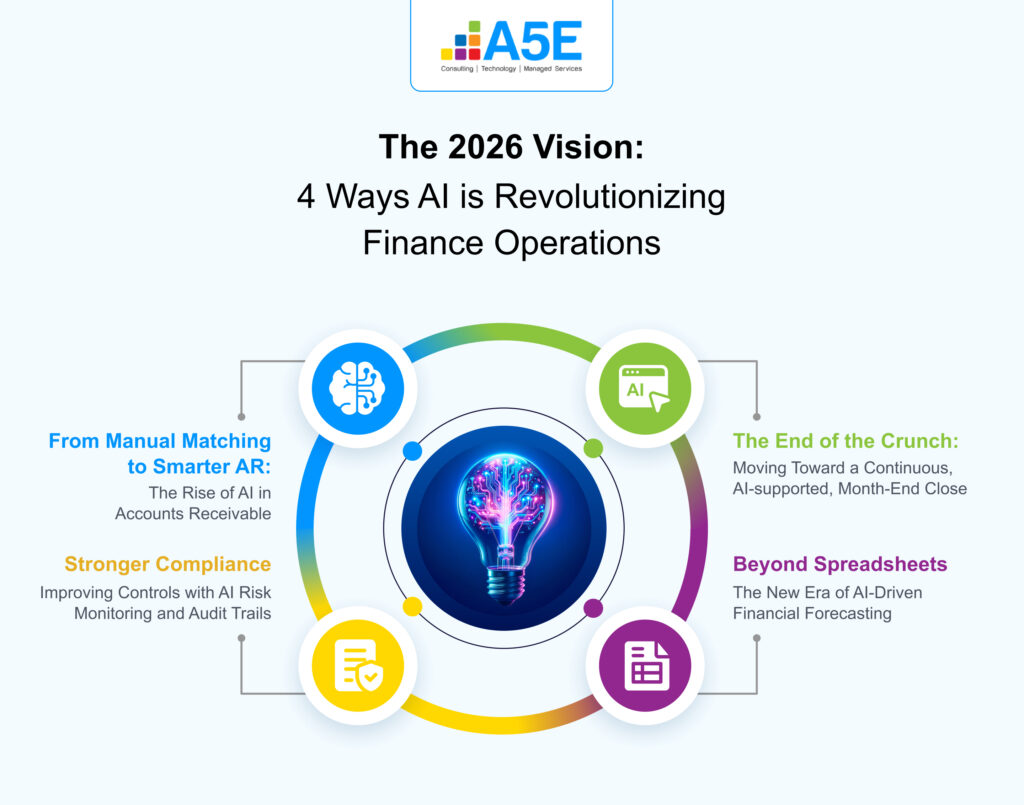

The 2026 Vision: 4 Ways AI is Revolutionizing Finance Operations

In 2026, many finance teams are moving beyond a manual, reactive model. More routine work is increasingly automated, insights are available more frequently, and decisions are supported by predictive analytics rather than static reports.

For CFOs and finance leaders, this is more than a technology upgrade—it’s an operating-model shift. Below are four core areas where AI in finance is delivering tangible impact and setting the direction for the next generation of digital finance operations.

From Manual Matching to Smarter AR: The Rise of AI in Accounts Receivable

Cash application has long been one of the most time-consuming parts of finance operations. Teams spend hours matching payments to invoices, resolving short-pays, and managing exceptions across multiple systems.

AI significantly reduces this burden. Using machine learning, AI-driven accounts receivable systems can ingest remittance data from multiple sources—emails, PDFs, EDI files, and bank statements—and automatically reconcile them with over 95% accuracy. Intelligent exception handling helps the system learn from past outcomes, improving match rates over time.

The result? Lower DSO, fewer write-offs, and freed-up bandwidth for AR teams to focus on collections strategy and customer relationships. For organizations looking to improve cash flow and working capital, automated AR and AI cash application are becoming key components of finance automation.

The End of the Crunch: Moving Toward a Continuous, AI-supported Month-End Close

The month-end close has traditionally been a high-stress, deadline-driven process. Finance and accounting teams scramble to reconcile accounts, post journal entries, and validate intercompany transactions, often ending up working late nights to hit reporting deadlines.

AI supports a new model: a more continuous close. By running reconciliations and validations more frequently—and flagging exceptions earlier—AI finance tools help CFOs maintain a more timely and reliable view of financial health. Machine learning models can identify anomalies and route them for review before they become reporting issues.

Instead of waiting weeks for accurate numbers, leadership teams gain on-demand visibility into performance. This shift from periodic reporting to more continuous finance operations helps finance move from reactive processing to proactive decision support.

Beyond Spreadsheets: The New Era of AI-Driven Financial Forecasting

Traditional forecasting relies heavily on historical data and manual inputs, which can struggle to capture today’s market complexity. The result is often static models that lose relevance quickly.

AI-enabled forecasting goes further by combining internal data (sales, expenses, cash flow) with external signals such as supply chain trends and macroeconomic indicators to produce scenario-based forecasts that can be refreshed more frequently.

These models learn from new data over time, helping finance teams test scenarios, assess risks, and update assumptions faster. For CFOs, this supports quicker planning cycles and better-informed decisions under uncertainty.

Stronger Compliance: Improving Controls with AI Risk Monitoring and Audit Trails

In an age of increasing regulatory scrutiny, compliance is non-negotiable. Yet many organizations still rely on manual reviews that can miss subtle patterns of fraud or error.

AI-assisted risk monitoring can analyze transactions continuously and flag anomalies that human reviewers might overlook—such as duplicate invoices, unusual vendor payments, or out-of-policy approvals. Actions and changes can be logged in detailed, time-stamped audit trails to support traceability and accountability.

For CFOs, this delivers dual value: stronger controls and reduced audit fatigue, with greater confidence that financial operations are both efficient and well-governed.

The Modern Finance Operations Toolkit: AI Financial Software for 2026

In 2026, the financial software ecosystem will be dominated by AI-first platforms. Here’s how the landscape is evolving, and where A5E Consulting plays a pivotal role.

- FP&A Platforms:

Modern financial planning and analysis (FP&A) tools now use AI to automate budgeting, planning, and forecasting cycles. Enterprise tools such as Anaplan, Workday Adaptive Planning, and SAP Analytics Cloud continuously integrate live business data, helping CFOs pivot plans instantly in response to real-world events. - Risk & Compliance Systems:

Next-gen governance platforms such as SAP GRC, Workiva, and Oracle Risk Management Cloud employ AI to detect fraud patterns, monitor policy adherence, and ensure audit readiness that ultimately helps in cutting compliance costs while enhancing transparency. - AP/AR Automation Solutions:

This is where A5E Consulting delivers measurable impact. Leveraging its expertise in SAP, Salesforce, and enterprise AI services, A5E’s AI-driven Cash Application solution implements intelligent AR and AP automation frameworks that integrate seamlessly into existing ERP environments. These systems reduce manual effort by over 80%, accelerate cash flow, and build resilient digital foundations for finance teams to scale confidently into the future.

As a digital transformation partner, A5E helps finance leaders select, deploy, and optimize AI-enabled finance software aligned with business goals—improving cycle times, control consistency, and decision-making support, not just automating tasks.

The Human Element: Preparing Your Team for Digital Transformation in Finance with AI

Technology can modernize processes, but adoption depends on people. The success of AI in finance is shaped as much by operating habits and accountability, as it is by tools.

As AI takes over repetitive, rules-based tasks like reconciliations, postings, and data validation, finance professionals are increasingly shifting toward exception management, analysis, and business partnering. Their new currency is not manual accuracy, but analytical insight and cross-functional influence. CFOs can accelerate this transition by redefining roles, redesigning workflows, and building a culture where human judgement and machine outputs are used together—especially when decisions carry risk.

A practical 3-step approach for CFOs in 2026:

- Start with ownership: Define who owns exception queues, who reviews AI-suggested outputs (such as matches, journals, or forecasts), and who is accountable for control sign-off.

- Build the right skills: Upskill teams in data literacy, scenario modeling, and AI governance so they can interpret outputs, challenge assumptions, and take action with confidence.

- Measure adoption—not just implementation: Track outcomes such as shorter cycle times, fewer exceptions, fewer late adjustments, and smoother audits, rather than focusing only on tool usage.

Upskilling is central to this change. Finance teams benefit from training in data literacy, scenario modeling, and AI governance, along with the ability to interpret AI outputs, challenge assumptions, and translate insights into action. Some organizations are introducing hybrid roles such as Finance Data Analyst or AI Process Controller to bridge financial expertise with digital fluency.

Change management also plays a critical role. Clear communication about “why AI”, early involvement of teams in tool selection, and well-defined success metrics help build trust and improve adoption. When teams see AI as a co-pilot that reduces repetitive work and improves decision support, adoption tends to move faster.

Ultimately, the human element defines the success of any digital transformation. AI can elevate finance—but only when empowered teams guide it with clear ownership, skills, and governance.

Conclusion: Your Roadmap to Building a Future-Ready Finance Function

The future of finance isn’t approaching; it’s here. By 2026, AI in finance will be the new baseline for high-performing enterprises. Organizations that continue to rely on manual, fragmented systems will struggle to compete on agility, insight, and compliance.

AI empowers finance teams to close faster, forecast smarter, and operate with unprecedented transparency. It transforms finance from a cost center into a strategic partner that shapes business outcomes in real time.

At A5E Consulting, we help enterprises harness enterprise AI finance solutions that accelerate this evolution, from intelligent cash application and autonomous reconciliation to predictive forecasting and continuous compliance.

Now is the time to act. Redefine your finance operations for 2026 and beyond with A5E as your trusted partner in the AI-driven transformation of enterprise finance.

Contact us today for a demo or consultation

Related Posts

Post a Comment cancel reply

You must be logged in to post a comment.