Cash App: A5E’s AI-Powered Cash Application

The Month-end Closing Challenge

Manual A/R Processing Bottlenecks

Traditional cash application slows financial workflows. Manual payment matching consumes staff time and introduces costly errors that ripple through accounting systems.

Data Silos and Integration Issues

Information scattered across systems makes aligning invoices before deadlines difficult. A/R teams juggle remittance emails, bank statements, and SAP screens, causing delayed postings and frustrated customers.

Scalability and Operational Constraints

As transaction volumes grow, manual inefficiencies increase resource strain and operational risk. Reliance on specialized staff concentrates knowledge in a few individuals, creating vulnerability.

Fragmented Remittance Sources

Working Capital Visibility Gaps

Complex Matching Drives Manual Work

Posting Delays Reduce Visibility

Fine-Tuning & Optimization

- Fine-tune LLMs with your proprietary data

Customize general-purpose models using internal documents, chat logs, or support tickets to improve domain relevance and accuracy. - Optimize hyperparameters for performance gains

Run experiments to fine-tune learning rates, batch sizes, and other model parameters for better convergence and output quality. - Apply model distillation to improve efficiency

Convert large, complex models into smaller, faster variants that retain core capabilities—ideal for edge deployment or real-time use. - Benchmark performance and detect biases

Continuously measure model outputs for quality, fairness, and unintended biases using both quantitative and human-in-the-loop evaluations. - Reduce model size and complexity for faster deployment

Use quantization, pruning, or architecture simplification to minimize compute costs without compromising accuracy.

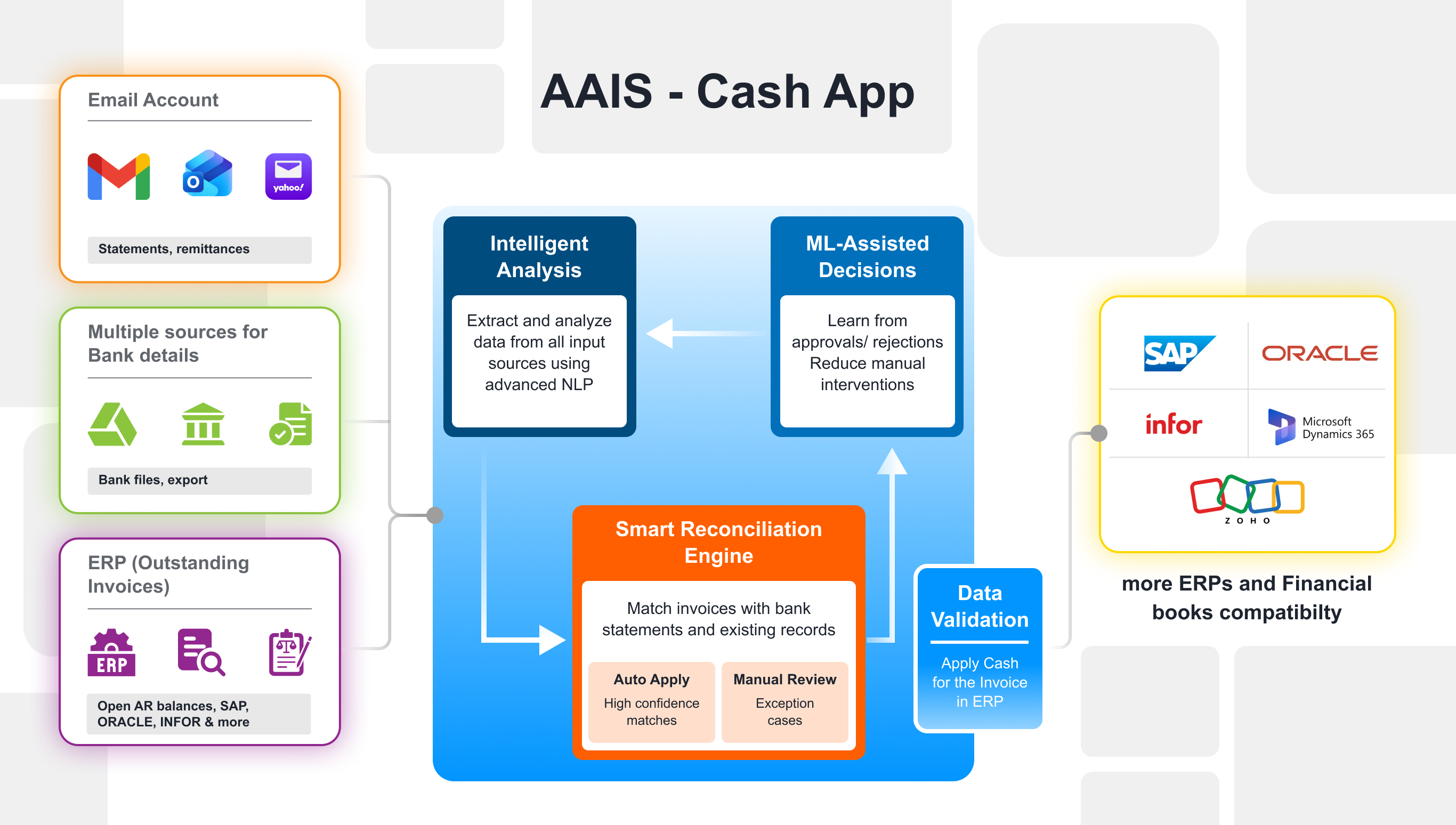

A5E's AI-Powered Cash Application Solution

AI-Enabled Email Processing

Standardized Remittance Data

Smart Matching & Self-Learning Automation

Exception Resolution Workspace

Governed ERP Posting & Insights

Enterprise-Grade Security & Fast Deployment

Operational Benefits You Can Expect

Accelerated Month-End Closing

With 90%+ straight-through posting and only exceptions requiring human review, invoices clear faster, cash hits the books sooner, and you stay ahead of the month-end chaos instead of chasing it.

Enhanced ERP Productivity

Direct integration with leading ERPs such as SAP, Oracle, Infor and Microsoft Dynamics 365, eliminates duplicate data entry and increases productivity by 20-40% per analyst. Your team works within familiar environments while benefiting from AI-powered automation that respects your existing workflows.

Scalable Implementation Model

The proof-of-concept approach enables go-live in as little as 14 days, with minimal disruption to ongoing operations. Once configured for your primary processes, expansion to additional business units requires minimal time compared to initial deployment.

Comprehensive Audit Trail

All processed emails are labeled and tracked, creating complete visibility into AI actions. Daily, monthly, quarterly, and customer reports provide role-based insights into cash application performance and exception patterns.

Accelerated Month-End Closing

Finance teams can close faster and reconcile payments without stress, focusing on strategic work instead of manual data entry. Invoices get cleared faster, cash hits the books sooner, and you stay ahead of the month-end chaos, instead of chasing it.

Enhanced ERP Productivity

Direct SAP integration eliminates duplicate data entry and increases productivity by 20%. Your team works within familiar SAP environments while benefiting from AI-powered automation that respects your existing workflows.

Scalable Implementation Model

The proof-of-concept approach allows rapid replication across multiple email accounts and company codes. Once configured for your primary processes, expansion to additional business units requires minimal time compared to initial deployment.

Comprehensive Audit Trail

All processed emails are labeled and tracked, creating complete visibility into AI actions. Daily, monthly, quarterly, and customer reports provide role-based insights into cash application performance and exception patterns.

A5E's Implementation Approach

Fast Pilot, Low Lift

14-Day Implementation Timeline

Proven ERP Compatibility

Speed & Efficiency by Design

Why Choose A5E Consulting

Established GenAI Expertise

A5E brings unique advantages through our established track record in Generative AI and enterprise solution delivery. Our end-to-end capabilities span from assessment through deployment and ongoing support.

Industry Knowledge and Global Reach

Deep financial process knowledge and regulatory expertise ensure solutions meet complex enterprise demands. Our global presence across USA, India, and UK provides local support with international expertise.

Technology Flexibility

Technology agnostic approaches support various AI engines and platforms, ensuring the best fit for your requirements. Enterprise-grade security and privacy protection are built into every solution

Proven Track Record

Our successful Enterprise AI application implementations demonstrate the expertise needed for AI-driven cash application automation, providing confidence in delivering promised results.

Ready to Revolutionize Your Cash Application Process?

Transform your accounts receivable operations with A5E’s AI-powered solution and join leading organizations that have already modernized their cash application processes.

Our dedicated GenAI specialists are ready to discuss your specific requirements and demonstrate how our AI tools can address your unique A/R challenges.